How Clark Wealth Partners can Save You Time, Stress, and Money.

What Does Clark Wealth Partners Do?

Table of ContentsFascination About Clark Wealth PartnersHow Clark Wealth Partners can Save You Time, Stress, and Money.9 Easy Facts About Clark Wealth Partners ExplainedGetting The Clark Wealth Partners To WorkSome Known Incorrect Statements About Clark Wealth Partners Some Of Clark Wealth PartnersThe Definitive Guide to Clark Wealth PartnersClark Wealth Partners Fundamentals Explained

Whether your objective is to optimize lifetime giving, make sure the care of a reliant, or assistance charitable causes, tactical tax obligation and estate preparation aids protect your tradition. Spending without a method is just one of the most usual pitfalls when building wide range. Without a clear plan, you might catch panic marketing, frequent trading, or profile misalignment.I've tried to mention some that mean something You really desire a generalist (CFP) that might have an extra credential. The CFP would certainly after that refer you to or work with attorneys, accounting professionals, and so on.

Clark Wealth Partners Fundamentals Explained

This is most likely on the phone, not in individual, if that matters to you. commissions. (or a mix, "fee-based"). These organizers remain in part salespeople, for either financial investments or insurance policy or both. I 'd remain away but some people are comfy with it - https://disqus.com/by/blancarush/about/. percentage-of-assets fee-only. These coordinators obtain a charge from you, however as a percent of investment properties managed.

There's a franchise business Garrett Planning Network that has this kind of planner. There's a company called NAPFA () for fiduciary non-commission-based coordinators.

Some Known Incorrect Statements About Clark Wealth Partners

There are about 6 books to dig through. You won't be a skilled professional at the end, however you'll recognize a great deal. To get an actual CFP cert, you require 3 years experience in addition to the training courses and the examination - I haven't done that, simply the book knowing.

bonds. Those are the most essential investment decisions.

The Main Principles Of Clark Wealth Partners

No two people will have rather the very same collection of financial investment strategies or remedies. Depending on your goals as well as your tolerance for threat and the moment you need to pursue those objectives, your advisor can assist you determine a mix of investments that are suitable for you and designed to assist you reach them.

Ally Bank, the business's direct financial subsidiary, provides a range of down payment items and services. Credit report products are subject to approval and additional terms and conditions apply.

, is a subsidiary of Ally Financial Inc. The details had in this short article is given for basic informational objectives and ought to not be construed as investment guidance, tax obligation guidance, a solicitation or deal, or a suggestion to acquire or sell any type of protection.

The Best Strategy To Use For Clark Wealth Partners

Stocks products are andOptions involve danger and are not appropriate for read this article all financiers. Alternatives investors may shed the entire quantity of their financial investment or even more in a relatively brief duration of time.

How Clark Wealth Partners can Save You Time, Stress, and Money.

App Store is a solution mark of Apple Inc. Google Play is a trademark of Google Inc. Zelle and the Zelle associated marks are wholly possessed by Very early Warning Services, LLC and are made use of here under permit. Ally and Do It Right are authorized service marks of Ally Financial Inc.

Managing your financial future can feel frustrating. With many moving partsinvestments, retirement, tax obligation approaches, threat administration, and estate planningit's easy to feel shed. That's where financial consultants and financial coordinators come inguiding you with every decision. They can function together to help you plan and remain on track to reach your objectives, yet their functions stand out.

Getting My Clark Wealth Partners To Work

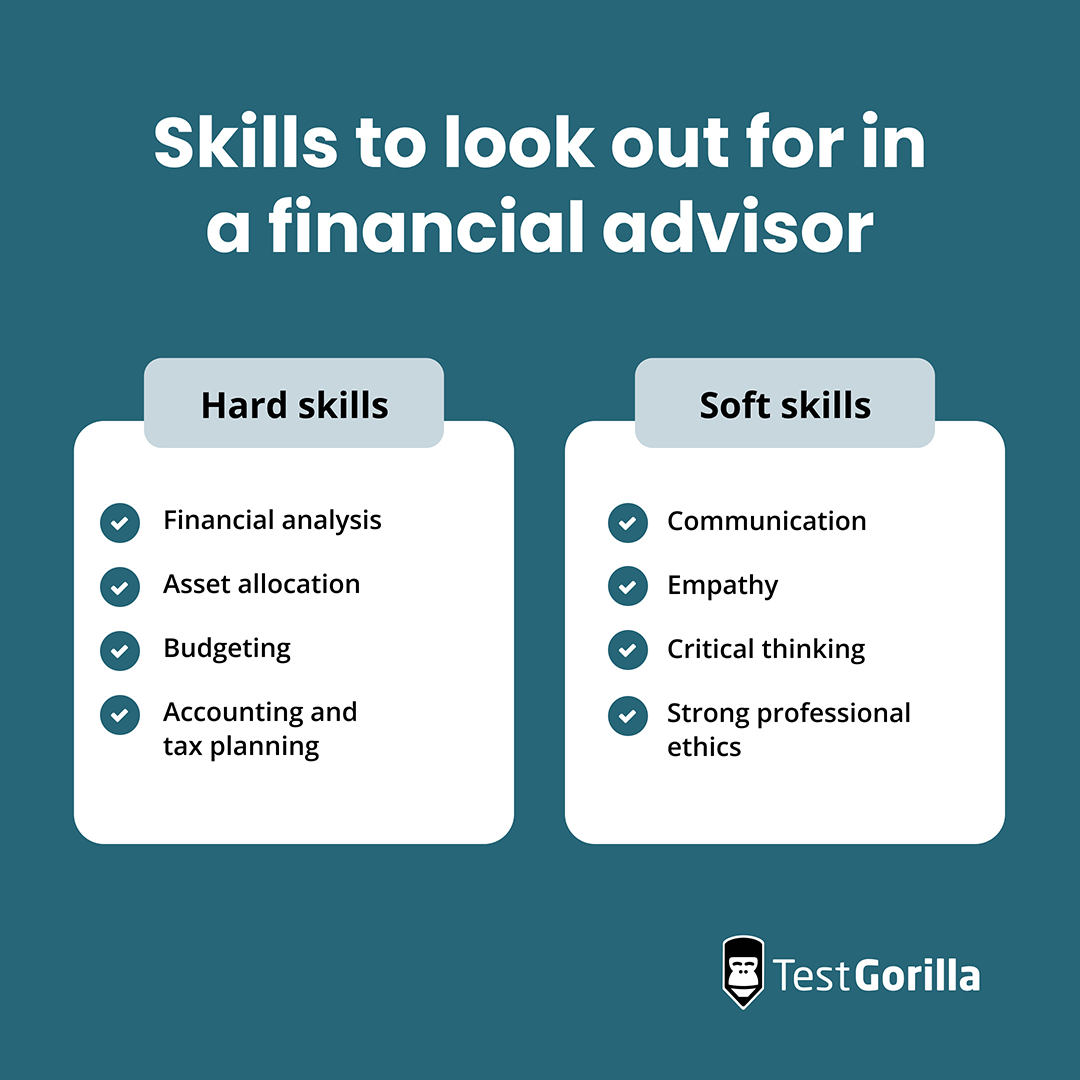

An economic expert aids maintain you grounded in the day-to-day, while a financial coordinator guarantees your decisions are based on lasting objectives. Financial advisors and monetary planners each bring different skill collections to the table.

Do you prepare to retire one day? These are all sensible and possible economic goals. And that's why it might be a good concept to get some professional help.

About Clark Wealth Partners

While some experts provide a vast variety of solutions, several specialize only in making and managing investments. A good advisor ought to have the ability to provide guidance on every aspect of your monetary circumstance, though they may concentrate on a specific area, like retirement preparation or wide range management. See to it it's clear from the get-go what the price includes and whether they'll spend more time concentrating on any location.